Dealing with debt can be an overwhelming and stressful experience. If you’re struggling to make ends meet and wondering if there’s a way out, you’re not alone. Many people in Florida, just like you, are searching for solutions to their financial problems. One option that might be worth considering is filing bankruptcy Chapter 13. This type of bankruptcy can provide you with the opportunity to restructure your debts and regain control over your finances. In this article, we’ll discuss when filing Chapter 13 is a good idea and how it can help you achieve a brighter financial future.

What is Chapter 13 Bankruptcy?

Chapter 13 bankruptcy, also known as the wage earner’s bankruptcy, is a type of bankruptcy designed for individuals with regular income who are struggling to pay their debts. This type of bankruptcy allows you to create a debt repayment plan that can last from three to five years, depending on your income and the amount of debt you have. During this time, you’ll make monthly payments to a bankruptcy trustee, who will distribute the funds to your creditors.

The primary goal of Chapter 13 bankruptcy is to help you reorganize your debts and create a manageable repayment plan that allows you to keep your assets, such as your home and car, while paying off your debts over time.

When is Filing Chapter 13 Bankruptcy a Good Idea?

There are several situations where filing Chapter 13 bankruptcy may be a good idea for you. Some of the most common reasons include:

1. You have secured debts:

If you have secured debts, such as a mortgage or car loan, Chapter 13 can help you catch up on missed payments and prevent foreclosure or repossession. By including these debts in your repayment plan, you can spread the arrears over the life of the plan, making it easier to catch up and keep your property.

2. You have non-dischargeable debts:

Certain debts, such as child support, alimony, and some tax debts, cannot be discharged in a Chapter 7 bankruptcy. However, Chapter 13 allows you to include these debts in your repayment plan, which can help you pay them off over time.

3. You want to protect your assets:

Chapter 13 bankruptcy allows you to keep your assets, such as your home and car, as long as you continue to make your monthly plan payments. This can be especially beneficial if you have equity in your property that you want to protect.

4. You have a regular income:

To qualify for Chapter 13 bankruptcy, you must have a regular income that can support your monthly plan payments. If you have a steady job and can afford to make these payments, Chapter 13 may be a good option for you.

5. You’ve filed for bankruptcy before:

If you’ve filed for Chapter 7 bankruptcy in the past and are not yet eligible to file again, Chapter 13 may be an option for you. There are no time restrictions on filing for Chapter 13 after a prior bankruptcy, as long as you meet the other eligibility requirements.

Understanding the Chapter 13 Process

Filing for Chapter 13 bankruptcy involves several steps, including:

1. Credit counseling: Before you can file bankruptcy, you must complete a credit counseling course from an approved agency. This course will help you understand your financial situation and explore your debt relief options.

2. Filing bankruptcy forms: You’ll need to complete and file the official bankruptcy forms with the bankruptcy court, including a detailed list of your assets, debts, income, and expenses.

3. Developing a repayment plan: With the help of a bankruptcy attorney, you’ll create a repayment plan that outlines how you’ll pay off your debts over the course of your bankruptcy. This plan will be submitted to the court for approval.

4. Confirmation hearing: A bankruptcy judge will review your repayment plan and either approve it or request changes before it can be confirmed.

5. Making plan payments: Once your plan is confirmed, you’ll begin making monthly payments to the bankruptcy trustee, who will distribute the funds to your creditors.

6. Debtor education: Before your bankruptcy can be discharged, you must complete a debtor education course from an approved provider.

7. Discharge: After you’ve completed your repayment plan and met all other requirements, your remaining eligible debts will be discharged, and you’ll be free from your financial burdens.

Filing for Chapter 13 bankruptcy can be a complex process, but with the help of an experienced bankruptcy attorney, you can navigate the system and work towards a brighter financial future. If you’re struggling with debt and considering your options, contact LSS Law for a free consultation to discuss your situation and learn more about whether Chapter 13 bankruptcy is the right choice for you.

What Debts Can Be Included in a Chapter 13 Repayment Plan?

In a Chapter 13 bankruptcy, you can include a variety of debts in your repayment plan. Some of the most common types of debts that can be addressed through Chapter 13 include:

Secured debts: Secured debts, such as mortgage payments and car loans, can be included in your repayment plan. Chapter 13 allows you to catch up on missed payments and prevent foreclosure or repossession of your property.

Unsecured debts: Unsecured debts, like credit card debt and medical bills, can also be included in your plan. You may not be required to pay off these debts in full, and any remaining balances may be discharged at the end of your plan.

Priority debts: Certain debts, such as child support, alimony, and some tax debts, are considered priority debts and must be paid in full through your Chapter 13 repayment plan.

By including these various types of debts in your Chapter 13 plan, you can work towards a more stable financial future and regain control over your finances.

The Impact of Chapter 13 Bankruptcy on Your Credit Report

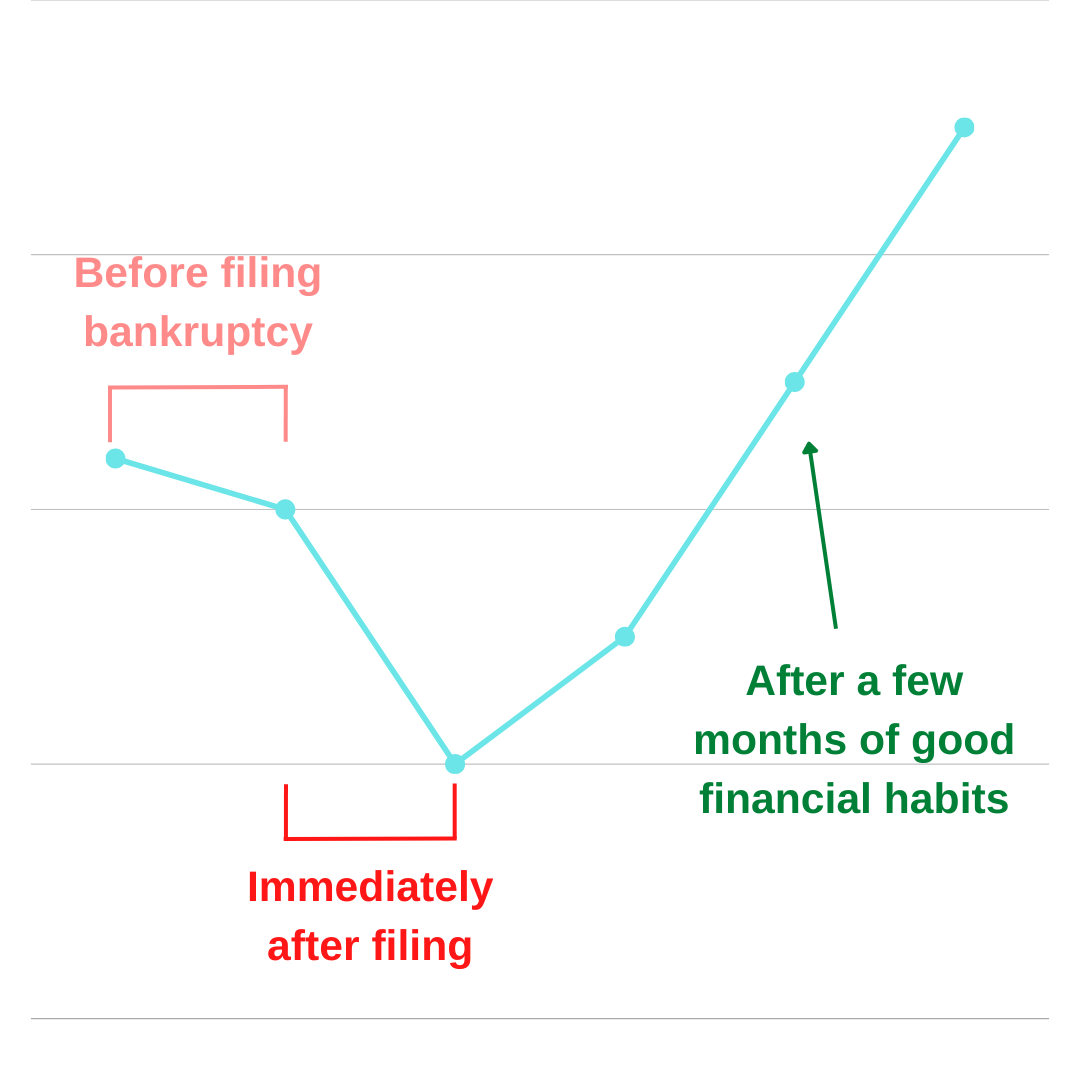

It’s important to understand the impact that filing for Chapter 13 bankruptcy can have on your credit report. When you file for bankruptcy, the information is reported to the credit bureaus and will remain on your credit report for up to ten years from the date of filing.

While your credit score may initially decrease after filing for bankruptcy, it’s important to remember that this is not a permanent situation. By making your monthly plan payments on time and responsibly managing your finances moving forward, you can work towards rebuilding your credit over time.

Additionally, many lenders view Chapter 13 bankruptcy more favorably than Chapter 7, as it demonstrates your commitment to repaying your debts rather than simply having them discharged. As you progress through your repayment plan and demonstrate responsible financial behavior, you may find that your credit score begins to improve and that you have more opportunities for credit in the future.

Managing Monthly Living Expenses During Chapter 13

One of the challenges you may face during your Chapter 13 bankruptcy is managing your monthly living expenses while also making your plan payments. It’s essential to create and stick to a budget that accounts for all of your necessary expenses, such as housing, utilities, groceries, and transportation.

Here are some tips for managing your monthly living expenses during Chapter 13:

1. Create a detailed budget: Track all of your income and expenses to gain a clear understanding of your financial situation. This will help you identify areas where you can cut back and allocate funds towards your plan payments.

2. Prioritize essential expenses: Focus on paying for necessities like housing, utilities, food, and transportation before allocating funds towards non-essential items.

3. Cut back on discretionary spending: Look for areas where you can reduce spending, such as dining out, entertainment, and shopping. Redirect those funds towards your plan payments and essential expenses.

4. Consider refinancing or modifying loans: If you have high-interest loans, such as car loans or personal loans, consider refinancing them to lower your interest rate and monthly payments. This can free up additional funds to put towards your plan payments.

5. Seek professional financial advice: If you’re struggling to manage your finances during Chapter 13, consider working with a financial advisor or credit counselor who can help you create a sustainable budget and provide guidance on managing your money.

By carefully managing your monthly living expenses during Chapter 13, you can increase your chances of successfully completing your repayment plan and achieving lasting debt relief.

The Importance of Credit Counseling and Debtor Education

Before and after filing for Chapter 13 bankruptcy, you will be required to complete credit counseling and debtor education courses. These courses are designed to help you better understand your financial situation, learn how to manage your money, and avoid future financial pitfalls.

Credit counseling: This course must be completed before you file for bankruptcy. It will help you evaluate your financial situation, explore alternative debt relief options, and determine if bankruptcy is the right choice for you. After completing the course, you will receive a certificate that must be submitted with your bankruptcy paperwork.

Debtor education: After filing for bankruptcy, you will need to complete a debtor education course before receiving your bankruptcy discharge. This course focuses on personal finance management, teaching you how to create a budget, manage credit, and make informed financial decisions moving forward.

By completing these courses, you will gain valuable knowledge and skills that can help you better manage your finances and avoid future financial difficulties.

The Benefits of Hiring a Bankruptcy Attorney for Chapter 13

Hiring a bankruptcy attorney to guide you through the Chapter 13 process can provide numerous benefits, helping you navigate the complexities of bankruptcy law and increasing your chances of a successful outcome. Some of the key advantages of working with a bankruptcy attorney include:

Expert legal advice: A knowledgeable bankruptcy attorney can help you understand the intricacies of Chapter 13, ensuring that you make informed decisions throughout the process.

Assistance with paperwork: Bankruptcy forms can be complicated and time-consuming. A bankruptcy attorney can help you gather the necessary documentation, complete the forms accurately, and submit them to the court in a timely manner.

Representation in court: Your bankruptcy attorney will represent you in bankruptcy court, advocating on your behalf and ensuring that your rights are protected.

Negotiating with creditors: A bankruptcy attorney can help you negotiate with your secured and unsecured creditors, potentially reducing your overall debt and making your repayment plan more manageable.

Guidance on rebuilding credit: After completing your Chapter 13 bankruptcy, your attorney can provide advice on how to rebuild your credit and maintain a strong financial future.

By enlisting the help of a bankruptcy attorney, you can alleviate some of the stress and uncertainty associated with Chapter 13 bankruptcy and increase your chances of achieving lasting debt relief.

The Difference Between Secured and Unsecured Debts in Chapter 13

In a Chapter 13 bankruptcy, it’s important to understand the difference between secured debts and unsecured debts, as they are treated differently in your repayment plan.

Secured debts are those that are backed by collateral, such as a mortgage or car loan. If you default on a secured debt, the creditor has the right to seize the collateral to satisfy the debt. In a Chapter 13 repayment plan, you must continue making your regular mortgage payments and car payments, as well as any missed payments or arrears, over the course of your plan.

Unsecured debts are those that are not backed by collateral, such as credit card debt, medical bills, and personal loans. These debts are generally considered lower priority in a Chapter 13 repayment plan, and you may not be required to repay them in full. The amount you pay towards your unsecured debts will depend on factors such as your disposable income, the length of your repayment plan, and the total amount of your unsecured debt.

By understanding the distinction between secured and unsecured debts, you can better navigate your Chapter 13 repayment plan and ensure that you are meeting your obligations to both types of creditors.

Meeting the Requirements for Chapter 13 Bankruptcy

Before filing for Chapter 13 bankruptcy, it’s essential to ensure that you meet the eligibility requirements outlined in the federal bankruptcy code. Some of the key criteria for filing Chapter 13 include:

Regular income: You must have a regular source of income to qualify for Chapter 13 bankruptcy, as you will be required to make monthly plan payments to your creditors. This income can come from various sources, such as employment, self-employment, or government benefits.

Debt limits: To qualify for Chapter 13 bankruptcy in Florida, your total secured and unsecured debts must not exceed $2.75 million. If your debts exceed this limit, you may not be eligible for Chapter 13 and should consider other debt relief options or consult with a bankruptcy attorney to discuss your situation.

Tax filings: You must be current with your federal income tax returns for the past four years before filing for Chapter 13 bankruptcy. If you haven’t filed your tax returns, you may need to do so before proceeding with your bankruptcy petition.

No prior bankruptcy petition: You cannot have had a prior bankruptcy petition dismissed within the past 180 days due to your failure to appear in court or comply with court orders.

Credit counseling course: You must complete a credit counseling course from an approved agency within 180 days before filing your bankruptcy paperwork.

By ensuring that you meet these requirements, you can move forward with your Chapter 13 bankruptcy filing with confidence.

When is Filing Bankruptcy Chapter 13 a Good Idea – Frequently Asked Questions

Navigating the complex world of bankruptcy law can be challenging, and you may have many questions about when filing bankruptcy chapter 13 is a good idea. We’ve compiled a list of frequently asked questions to help you better understand the process and determine if Chapter 13 is the right option for you.

What happens if I miss a monthly plan payment during my Chapter 13 bankruptcy?

If you miss a monthly plan payment during your Chapter 13 bankruptcy, your bankruptcy trustee may file a motion to dismiss your case or modify your repayment plan. It’s essential to communicate with your bankruptcy attorney and the trustee if you’re having difficulty making payments. They may be able to help you find a solution to avoid dismissal.

Can I discharge student loans through Chapter 13 bankruptcy?

Student loans are generally not dischargeable through Chapter 13 bankruptcy. However, you can include them in your repayment plan, potentially lowering your monthly payments during the plan. Once your Chapter 13 bankruptcy is completed, you will still be responsible for repaying any remaining student loan balance.

How long does Chapter 13 bankruptcy stay on my credit report?

Chapter 13 bankruptcy will remain on your credit report for up to ten years from the date of filing. However, it’s essential to remember that your credit score can improve over time if you follow the correct recommendations and maintain good financial habits.

Can I keep my house and car during Chapter 13 bankruptcy?

Yes, in most cases, you can keep your house and car during Chapter 13 bankruptcy as long as you continue making regular mortgage payments and car loan payments, as well as any additional payments required under your repayment plan. Your bankruptcy attorney can help you determine the best course of action for your specific situation.

Can I file for Chapter 13 bankruptcy if I’m self-employed?

Yes, self-employed individuals can file for Chapter 13 bankruptcy as long as they meet the eligibility requirements, including having a regular source of income. It’s essential to provide accurate and up-to-date financial information when filing for bankruptcy, so working with a knowledgeable bankruptcy attorney is crucial.

What happens if my financial situation changes during my Chapter 13 repayment plan?

If your financial situation changes during your Chapter 13 repayment plan, you may be able to modify your plan to accommodate these changes. You will need to work with your bankruptcy attorney and the bankruptcy trustee to propose a modified plan and obtain court approval.

Contact Us to Learn More About Chapter 13 Bankruptcy

If you’re struggling with debt and considering filing for Chapter 13 bankruptcy, our experienced bankruptcy attorneys at LSS Law are here to help. We’re committed to helping individuals and businesses in South Florida find the best debt relief solutions for their unique situations. To schedule a no-cost Bankruptcy Strategy Session for personal bankruptcies (Chapter 7 and 13), contact us by filling out the form on the right or by visiting our contact us page. You can also give us a call at 954-466-0541.