Dealing with a lot of debt can be scary and stressful. But don’t worry, you’re not alone, and there are ways to help you take control of your money again. One option is filing for bankruptcy, which can give you a fresh start and lead to a better future. In this article, we’ll talk about the differences between Chapter 7 and Chapter 13 bankruptcy, so you can figure out which one is best for you.

Chapter 7 Bankruptcy vs 13: Key Differences Explained

When considering filing bankruptcy, it’s critical to understand the distinctions between Chapter 7 and Chapter 13. Each type of bankruptcy has its own purpose and different pros and cons.

Chapter 7 Bankruptcy: Liquidation

Chapter 7 bankruptcy, also called liquidation bankruptcy, helps people get rid of their unsecured debts, like credit card balances, medical bills, and personal loans. In this process, a bankruptcy trustee is assigned to sell the debtor’s nonexempt property and use the money to pay unsecured creditors.

To be eligible for Chapter 7, you must pass a means test, which compares your household income to the median income in Florida and figures out your disposable income (the amount left after necessary living expenses). If you make too much money, you might not qualify for Chapter 7 and may need to consider Chapter 13 bankruptcy.

Click the link below to learn more about Chapter 7 bankruptcy in South Florida:

Learn About Chapter 7 Bankruptcy in South Florida

Chapter 13 Bankruptcy: Reorganization

Chapter 13 bankruptcy, also known as reorganization bankruptcy, is for people with a regular income who can afford to pay back some of their debts through a court-approved debt repayment plan. This type of bankruptcy lets you keep your property while making monthly payments to a bankruptcy trustee for 3 to 5 years.

Chapter 13 can be especially helpful for people who have missed mortgage payments, as it allows them to catch up on their payments and avoid foreclosure. Additionally, Chapter 13 can help manage tax debts and even remove unsecured junior liens (second or third mortgages) on your property, in some cases.

Click the link below to learn more about what combination of secured debt and unsecured debt are needed to qualify for Chapter 13 bankruptcy:

Bankruptcy – Chapter 13 Definition And Requirements

Which Bankruptcy Option is Right for You?

To figure out whether Chapter 7 or Chapter 13 bankruptcy is the best choice for you, you need to think about your specific financial situation and goals. Here are some things to consider when deciding between these two options:

- Income: If your income is too high to pass the means test, you might not be eligible for Chapter 7 and will need to think about Chapter 13.

- Assets: If you have nonexempt property that you want to keep, Chapter 13 might be a better choice, as it lets you keep your assets while making plan payments.

- Secured and priority debts: Chapter 13 can help you manage secured debts, like mortgage payments, and priority debts like child support and certain tax debts, which are not dischargeable in Chapter 7.

- Ability to make monthly payments: If you have enough income to make monthly payments towards your debts, Chapter 13 might be a better option for you.

In the end, the choice between Chapter 7 and Chapter 13 bankruptcy should be made after doing your research and talking to a knowledgeable bankruptcy lawyer. They can help you understand the eligibility requirements, potential outcomes, and long-term effects of each option, making sure you make the best decision for your financial future.

Why Bankruptcy Exemptions Matter

Bankruptcy exemptions are very important in both Chapter 7 and Chapter 13 bankruptcy cases. They enable you to keep some of your assets from being sold or incorporated into your payment plan. This helps you preserve a basic standard of living during and after the bankruptcy process. In Florida, some common bankruptcy exemptions are:

- Homestead exemption: This exemption protects any amount of money you have in your main home, but there are some limits based on the size of the property.

- Motor vehicle exemption: Florida’s motor vehicle exemption lets you protect up to $1,000 in car value.

- Retirement accounts: Most retirement accounts, like 401(k)s, IRAs, and pensions, are safe from being sold in a Florida bankruptcy.

- Wildcard exemption: Florida’s wildcard exemption lets you protect more of your personal property and the amount varies, depending on whether you also use the homestead exemption.

Knowing and using your bankruptcy exemptions is critical for minimizing the financial impact of bankruptcy. A skilled bankruptcy lawyer can assist you with these exemptions and ensure that you safeguard as much of your property as possible.

The Automatic Stay: Stopping Debt Collectors

One of the best things about filing for bankruptcy is the automatic stay. This is a court order that stops most collection actions against you for a little while. This means that as soon as you file for bankruptcy, your creditors must stop contacting you, taking money from your paycheck, and trying other ways to collect money from you. The automatic stay works for both Chapter 7 and Chapter 13 bankruptcy cases and can help you feel less stressed.

But, the automatic stay doesn’t work for some kinds of debts, like child support, alimony, and some tax debts. Also, the automatic stay may be lifted in certain circumstances, such as if the court gives a creditor permission to collect money from you again.

A bankruptcy attorney can help you understand how the automatic stay works and how it applies to your situation.

Dealing with Tax Debts in Chapter 13 Bankruptcy

One of the best things about Chapter 13 bankruptcy is that it can help you deal with tax debts without getting more penalties. In a Chapter 13 repayment plan, priority tax debts, like recent income tax debts, have to be paid in full. But, non-priority tax debts, like older income tax debts or tax penalties, might be partially paid or even wiped out at the end of your repayment plan.

It’s important to know that not all tax debts can be wiped out in Chapter 13 bankruptcy. For example, tax debts related to not filing tax returns or filing fake tax returns usually can’t be wiped out. Also, some tax liens might still be there after the bankruptcy process, even if the tax debt is wiped out. A bankruptcy attorney can help you understand how your specific tax debts will be treated in a Chapter 13 bankruptcy and make sure you do everything you can to get the most debt relief possible.

Fixing Your Credit After Bankruptcy

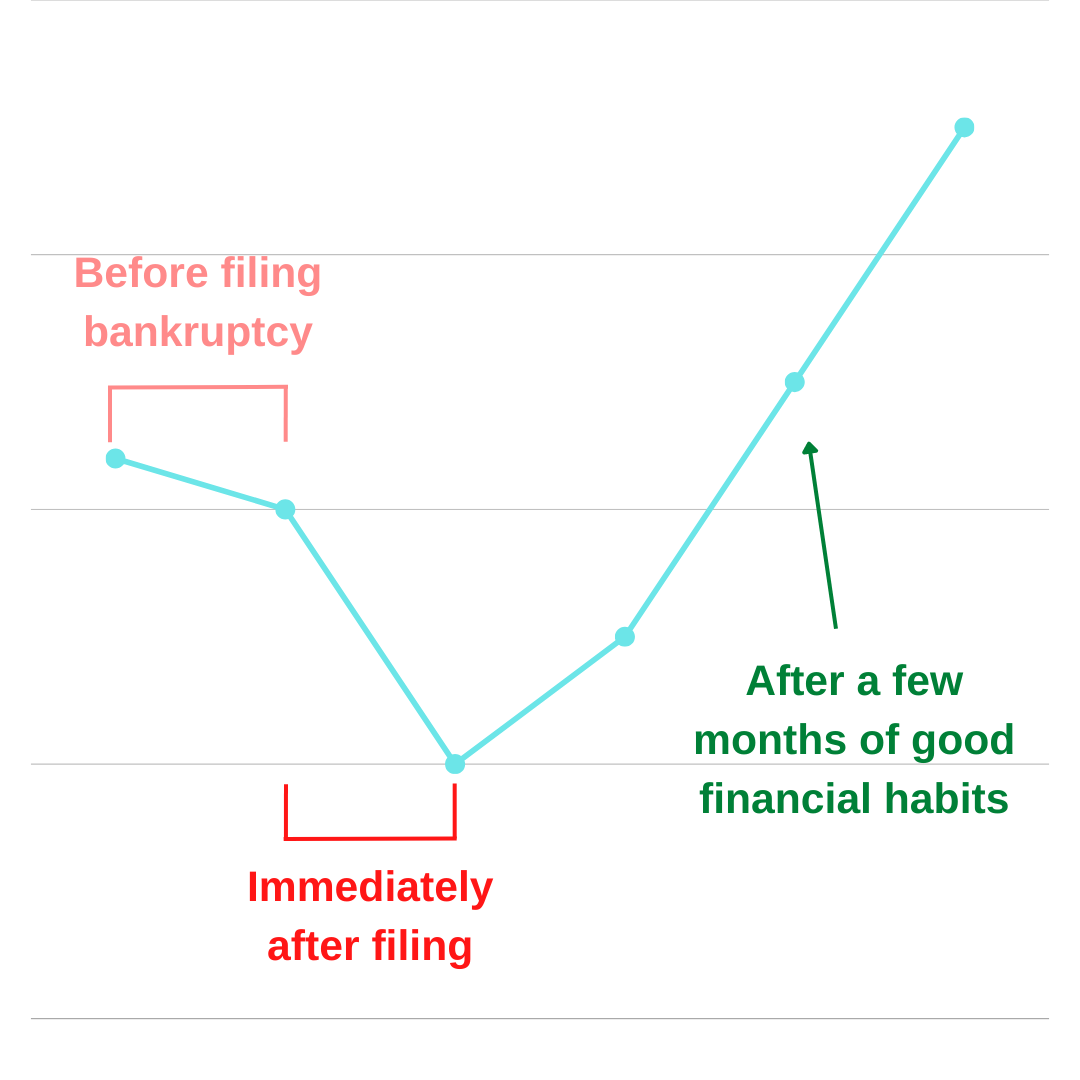

It’s true that filing for bankruptcy can hurt your credit score, but it’s important to remember that bankruptcy is not a permanent mark on your credit history. In fact, most people find that their credit score starts to get better after filing for bankruptcy, as long as they do the right things. Some steps you can take to fix your credit after bankruptcy are:

- Paying your bills on time: One of the most important things for your credit score is your payment history. By paying your bills on time, you will demonstrate responsibility for your future lenders.

- Using credit responsibly: After bankruptcy, it’s important to use credit the right way and not get into more debt. You might consider using a secured credit card or a small loan to show that you can make timely payments.

- Checking your credit report: Looking at your credit report regularly can help you find and fix any mistakes or things that aren’t right that might be making your credit score worse.

- Making and sticking to a budget: Making a realistic budget and living within your means will help you avoid further debt and prove your financial responsibility.

By doing these things and working with a bankruptcy attorney to go through the bankruptcy process, you can take control of your money situation and work towards a better financial future.

Getting Rid of Unsecured Junior Liens in Chapter 13 Bankruptcy

Chapter 13 bankruptcy lets you remove unsecured junior liens from your property through a process called lien stripping. This is especially helpful if you have more than one mortgage or home equity loan and your home’s value has gone down, leaving the junior liens unsecured.

To be eligible for lien stripping, your property’s value must be less than the balance of the first mortgage. This leaves the junior lien unsecured, and it will be considered an unsecured debt in your repayment plan if approved by the court. This could allow you to pay only a part of the debt or even have it discharged completely at the end of your repayment plan.

It’s important to talk with a bankruptcy attorney to find out if lien stripping is a choice for you and to make sure you take the necessary steps to successfully remove any unsecured junior liens from your property.

Keeping Co-Signers Safe in Chapter 13 Bankruptcy

If you have co-signed loans or joint credit accounts with friends or family members, filing for Chapter 13 bankruptcy can help protect them from creditors’ attempts to collect. In Chapter 13, the automatic stay provision applies not only to you but also to any co-signers on your qualifying debts.

Your co-signers will remain protected from collection actions, as long as you continue to make your plan payments on time. This can provide much-needed relief for your co-signers and help maintain your relationships with them. However, this protection only applies to certain types of debts, such as consumer debts, and not business debts. Additionally, if you fail to complete your repayment plan or your Chapter 13 case is dismissed, your co-signers may once again become responsible for the debts.

Working with a bankruptcy attorney can help ensure that you fully understand the protections available for your co-signers and that you take the necessary steps to maintain those protections throughout your bankruptcy process.

Common Questions About Chapter 7 Bankruptcy vs 13

To help you better understand the differences between Chapter 7 and Chapter 13 bankruptcy, we’ve put together a list of frequently asked questions and their answers. This FAQ section will clear up some common misunderstandings about bankruptcy issues.

What is the main difference between Chapter 7 and Chapter 13 bankruptcy?

The main difference between Chapter 7 and Chapter 13 bankruptcy is how debts are dealt with. In Chapter 7, non-exempt assets are sold to repay creditors and the remaining qualifying debts are discharged. In Chapter 13, a repayment plan is set up to pay off debts over a period of 3-5 years, allowing you to keep your assets.

Can I keep my home and car in both Chapter 7 and Chapter 13 bankruptcy?

In Chapter 7 bankruptcy, you may be able to keep your home and car if they are protected by Florida’s exemptions and you are current on your mortgage and car loan payments. In Chapter 13, you can generally keep your home and car as long as you continue making payments through your repayment plan.

How long do Chapter 7 and Chapter 13 bankruptcies stay on my credit report?

Chapter 7 bankruptcy stays on your credit report for ten years, while Chapter 13 bankruptcy remains for seven years. However, with responsible financial management, your credit score can improve over time, even with a bankruptcy filing on your report.

Can I eliminate student loan debt in Chapter 7 or Chapter 13 bankruptcy?

In most cases, student loan debt is not dischargeable in either Chapter 7 or Chapter 13 bankruptcy. However, if you can prove that repaying your student loans would cause undue hardship, you may be able to have them discharged.

Can I choose between Chapter 7 and Chapter 13 bankruptcy?

Eligibility for Chapter 7 and Chapter 13 bankruptcy depends on your income, assets, and the types of debts you have. You must pass the means test to qualify for Chapter 7, while Chapter 13 requires regular income and has debt limits. Consulting with a bankruptcy attorney can help you determine which option is best for your specific situation.

How much does it cost to file for Chapter 7 or Chapter 13 bankruptcy?

The current filing fee for Chapter 7 bankruptcy is $338, and for Chapter 13, it is $313. These fees are subject to change and do not include additional costs such as credit counseling, debtor education courses, or attorney’s fees.

What is the difference between bankruptcy liquidation, reorganization, and debt consolidation?

Bankruptcy liquidation, reorganization, and debt consolidation are distinct processes under the bankruptcy code for managing financial distress. Liquidation (Chapter 7) involves selling a debtor’s non-exempt assets to repay creditors, with remaining debts typically discharged. Reorganization (Chapter 11 or 13) allows debtors to restructure their debts, creating a court-approved repayment plan to satisfy creditors over time. Debt consolidation combines multiple debts into a single loan with more favorable terms, which is not part of the bankruptcy code but is an alternative option for debtors to manage their obligations without filing bankruptcy.

Contact Us to Learn More About Chapter 7 Bankruptcy vs 13

If you’re struggling with debt and thinking about bankruptcy, it’s essential to understand the differences between Chapter 7 and Chapter 13 bankruptcy and figure out the best option for your situation. Our experienced bankruptcy attorneys at LSS Law are here to help.

Contact us today to schedule a no-cost Bankruptcy Strategy Session by calling 954-466-0541 or emailing info@lsslaw.com. We are committed to helping you remove the financial burden and open the door to a brighter future.