Dealing with financial struggles can be incredibly stressful and overwhelming. If you’re drowning in debt and unsure of your options, you may be considering bankruptcy as a possible solution. But when is the right time to file for bankruptcy, and how can it help you regain control of your financial situation? In this article, we’ll explore the key factors to consider when deciding if bankruptcy is the right choice for you and how it can provide a fresh start.

When to File Bankruptcy: Understanding the Right Time

The decision to file for bankruptcy is a personal one that depends on several factors, including your financial situation, the type of debt you have, and your ability to repay your debts. Here are some important considerations to help you determine if now is the right time to file for bankruptcy:

Assess Your Financial Situation

Before you decide to file for bankruptcy, it’s essential to take a close look at your financial situation. This includes evaluating your income, expenses, assets, and outstanding debts. If you’re struggling to make ends meet and your debt is only increasing, filing for bankruptcy may be the right choice.

Consider the Type of Debt You Have

Not all debts can be discharged through bankruptcy. For example, student loan debt, child support, and certain tax obligations are typically not eliminated through bankruptcy. If the majority of your debt is made up of these types of obligations, filing for bankruptcy may not be the most effective solution.

Chapter 7 Bankruptcy: A Fresh Start for Those Who Qualify

Chapter 7 bankruptcy, also known as straight bankruptcy, is a type of bankruptcy that allows you to eliminate most of your unsecured debt, such as credit card debt, medical bills, and personal loans. To qualify for Chapter 7, you must pass a means test, which compares your income to the median income in your state. If your income is below the median, you may be eligible to file for Chapter 7.

Filing for Chapter 7 bankruptcy can provide a fresh start by wiping out your qualifying debts and allowing you to focus on rebuilding your financial future. However, it’s important to note that Chapter 7 may require you to sell some of your assets to pay creditors, so it’s essential to consult with a bankruptcy attorney to determine if this is the best option for you.

Chapter 13 Bankruptcy: A Repayment Plan for Those With Steady Income

If you don’t qualify for Chapter 7 bankruptcy, you may still be able to file for Chapter 13 bankruptcy, which allows you to create a repayment plan to pay off your debts over a period of three to five years. This type of bankruptcy is ideal for those with a steady income who can afford to make monthly payments towards their debt.

Filing for Chapter 13 bankruptcy can help you regain control of your finances by consolidating your debts into one monthly payment and potentially reducing the amount you owe. Additionally, it can help you avoid foreclosure on your home and protect your assets from being seized by creditors.

The Importance of Consulting with a Bankruptcy Attorney

Deciding when to file for bankruptcy and which type of bankruptcy is right for you can be a complex and challenging process. It’s crucial to consult with an experienced bankruptcy attorney who can help you navigate the bankruptcy process, evaluate your financial situation, and determine the best course of action for your specific circumstances.

Filing bankruptcy is a significant decision that should be made after carefully considering your financial situation, exploring other debt relief options, and consulting with a knowledgeable bankruptcy attorney. If you’re struggling with debt and unsure of your options, remember that bankruptcy is not the end of the world – it can be a financial tool that provides a fresh start and a path towards a brighter future.

The Bankruptcy Filing Process: What to Expect

Filing for bankruptcy can be a complex and overwhelming process, but understanding the steps involved can help alleviate some of the stress. Here’s a general outline of the bankruptcy filing process:

Pre-Filing Credit Counseling

Before you can file for bankruptcy, you must complete a credit counseling course from an approved credit counseling agency. This course is designed to help you understand your financial situation and explore other debt relief options before deciding to file for bankruptcy.

Gathering Documentation

You will need to gather various financial documents, such as pay stubs, tax returns, bank statements, and a list of all your debts and assets. This information will be used to complete the bankruptcy petition and schedules that must be submitted to the court.

Filing the Bankruptcy Petition

Once you have completed the necessary paperwork, your bankruptcy attorney will file the petition with the federal bankruptcy court. This initiates the bankruptcy process and provides you with an automatic stay, which temporarily stops collection efforts, foreclosures, and lawsuits against you.

Meeting of Creditors

Approximately 30 to 45 days after filing, you will be required to attend a meeting of creditors, also known as the 341 meeting. During this meeting, the bankruptcy trustee assigned to your case will ask you questions about your financial affairs, and creditors have the opportunity to ask questions as well.

Completing a Debtor Education Course

After the meeting of creditors, you must complete a debtor education course from an approved provider. This course is designed to help you learn how to manage your finances and avoid future debt problems.

Discharge of Debts

Once you have completed all required steps, the bankruptcy court will issue a discharge order, which eliminates your legal obligation to repay most of your debts. The exact timeline for this will depend on the type of bankruptcy you filed – Chapter 7 cases typically take about 3-6 months, while Chapter 13 cases can last 3-5 years due to the repayment plan.

By understanding the bankruptcy filing process and working closely with your bankruptcy attorney, you can navigate the legal complexities and work towards a fresh financial start.

Rebuilding Your Credit After Bankruptcy

While filing for bankruptcy can have a negative impact on your credit score initially, it’s important to remember that it’s not a permanent situation. With time and effort, you can rebuild your credit and improve your financial standing. Here are some tips to help you get started:

Review Your Credit Report

After your bankruptcy discharge, obtain a copy of your credit report to ensure that all discharged debts are accurately reported. If you find any errors, dispute them with the credit reporting agencies to have them corrected.

Establish New Credit

To rebuild your credit, you’ll need to establish new credit accounts. Start by applying for a secured credit card or a small personal loan. Be sure to make all payments on time and keep your balances low.

Create a Budget and Stick to It

Developing a realistic budget and sticking to it is essential for maintaining financial stability after bankruptcy. Track your income and expenses, and prioritize saving money and paying off any remaining debts.

Be Patient and Persistent

Rebuilding your credit after bankruptcy takes time and consistent effort. Stay committed to responsible financial habits, and over time, your credit score will improve.

Bankruptcy can provide a fresh start and a path to a brighter financial future. By understanding the roles of the bankruptcy trustee and court, and taking steps to rebuild your credit, you can regain control of your finances and move forward with confidence.

Bankruptcy and Your Car: Options for Auto Loans

If you’re considering bankruptcy and have an auto loan, you may be concerned about the fate of your vehicle. The good news is that there are options for dealing with car loans in bankruptcy:

Reaffirming the Car Loan in Chapter 7 Bankruptcy

In a Chapter 7 bankruptcy, you may be able to reaffirm your car loan, which means you agree to continue making payments on the loan and keep the vehicle. By reaffirming the loan, you essentially remove it from the bankruptcy process, and it will not be discharged. It’s important to carefully consider whether reaffirming the loan is in your best interest, as you will remain responsible for the debt after bankruptcy.

Redeeming the Vehicle in Chapter 7 Bankruptcy

Another option in Chapter 7 bankruptcy is to redeem the vehicle by paying the lender a lump sum equal to the current market value of the car. This can be beneficial if the car is worth less than the loan balance, as it allows you to eliminate the remaining debt.

However, this option requires access to a lump sum of cash, which may be challenging for many individuals in financial distress.

Retaining the Vehicle in Chapter 13 Bankruptcy

In a Chapter 13 bankruptcy, you can include your car loan in your repayment plan, allowing you to make more manageable monthly payments over the 3-5 year plan period. If your loan is more than 910 days old, you may also be able to cram down the loan, which reduces the balance to the current market value of the vehicle. At the end of the repayment plan, any remaining balance on the loan may be discharged.

By understanding your options for dealing with car loans in bankruptcy and working with an experienced bankruptcy attorney, you can make an informed decision about the best course of action for your situation.

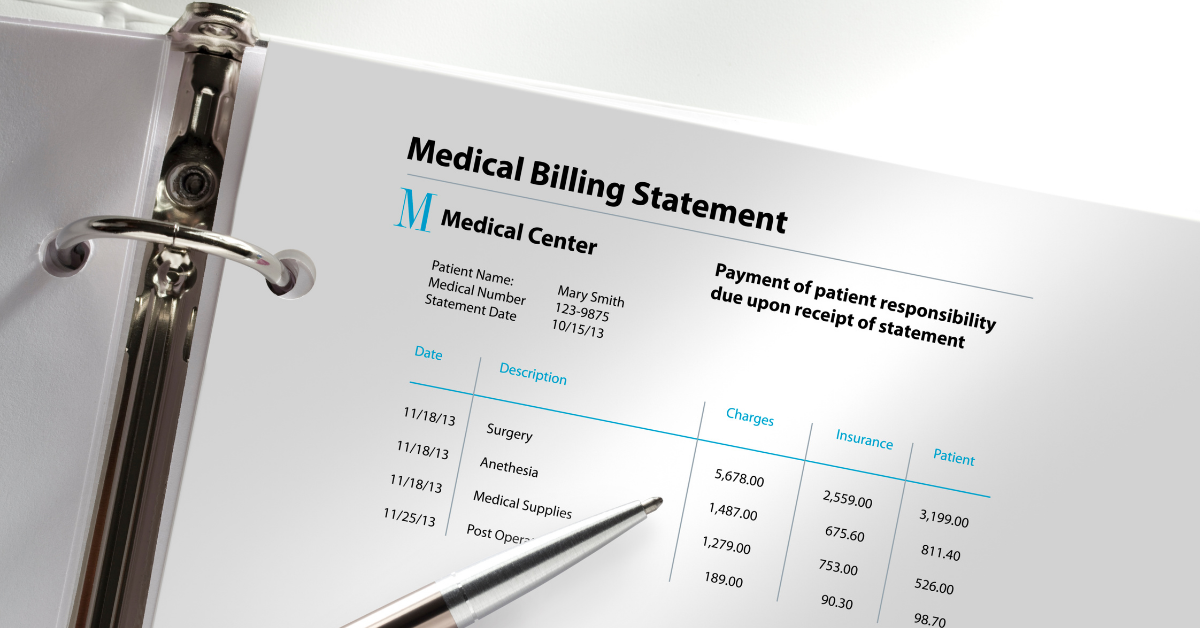

Bankruptcy and Medical Bills: How Chapter 7 Can Help

Medical bills are a common cause of financial distress for many individuals and families. If you are struggling with overwhelming medical debt, Chapter 7 bankruptcy may provide relief by discharging these unsecured debts. Here’s how Chapter 7 can help you address medical bills:

Discharging Medical Bills in Chapter 7 Bankruptcy

Medical bills are considered unsecured debt, which means they are not tied to any specific collateral, like a mortgage or auto loan. In a Chapter 7 bankruptcy, most unsecured debts, including medical bills, can be discharged, or eliminated, after the bankruptcy process is complete.

This means that you will no longer be legally obligated to pay these debts.

Protecting Your Assets During the Bankruptcy Process

While Chapter 7 bankruptcy involves the potential liquidation of non-exempt assets to repay creditors, many individuals are able to protect most, if not all, of their assets through bankruptcy exemptions. These exemptions can include your home, car, and personal belongings, depending on their value and the specific exemption laws in Florida.

Working with an experienced bankruptcy attorney can help you understand how bankruptcy exemptions apply to your situation and ensure that your assets are protected to the greatest extent possible.

Credit Counseling Agencies

Before you can file for bankruptcy, federal law requires that you complete a credit counseling course with an approved credit counseling agency.

This course is designed to help you understand your financial situation, explore alternative debt relief options, and determine whether bankruptcy is the right choice for you. Here’s what you can expect from credit counseling:

Pre-Bankruptcy Credit Counseling

The credit counseling course must be completed within 180 days before filing your bankruptcy petition. During the course, you will review your financial situation, including your income, expenses, and debts, with a certified credit counselor. The counselor will help you create a budget and discuss potential alternatives to bankruptcy, such as debt consolidation or a debt management plan.

Obtaining a Credit Counseling Certificate

Upon completion of the credit counseling course, you will receive a certificate of completion. This certificate must be filed with your bankruptcy petition as proof that you have satisfied the credit counseling requirement.

Post-Bankruptcy Debtor Education Course

In addition to the pre-bankruptcy credit counseling, you will also need to complete a debtor education course after filing your bankruptcy petition. This course focuses on financial management skills, such as budgeting, saving, and using credit responsibly, to help you avoid future financial difficulties.

Like the credit counseling course, you will receive a certificate of completion that must be filed with the bankruptcy court before your debts can be discharged.

Working with a credit counseling agency can help you understand your financial situation and make informed decisions about bankruptcy and other debt relief options. It’s essential to choose an approved agency and complete the required courses to ensure a smooth bankruptcy process.

Frequently Asked Questions About When to File Bankruptcy

Navigating the complex world of bankruptcy can be overwhelming, but we’re here to help. In this section, we’ll address some of the most frequently asked questions about bankruptcy when to file and provide answers to help you better understand your options.

How do I know if bankruptcy is the right choice for me?

Deciding to file for bankruptcy is a personal decision based on your unique financial situation. It’s essential to evaluate your debts, income, and assets, as well as explore other debt relief options before making this decision. Consulting with a bankruptcy attorney can provide valuable guidance and help you determine if bankruptcy is the best course of action for your circumstances.

Can I keep my home and car if I file for bankruptcy?

In many cases, you can keep your home and car when filing for bankruptcy, thanks to exemptions that protect certain assets from liquidation. However, this depends on the value of your assets and the specific exemption laws in Florida.

An experienced bankruptcy attorney can help you understand how these exemptions apply to your situation and ensure your assets are protected.

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

Chapter 7 bankruptcy is a liquidation process that discharges most unsecured debts, such as credit card debt and medical bills. Chapter 13 bankruptcy, on the other hand, involves a repayment plan that allows you to pay back a portion of your debts over a period of three to five years.

Your eligibility for each type of bankruptcy depends on factors such as your income, assets, and the results of the means test.

How long does bankruptcy stay on my credit report?

A Chapter 7 bankruptcy stays on your credit report for ten years, while a Chapter 13 bankruptcy remains for seven years. However, you can begin rebuilding your credit during this time by establishing new credit, paying bills on time, and maintaining a responsible financial lifestyle.

Will filing for bankruptcy stop creditor harassment?

Yes, filing for bankruptcy provides an automatic stay, which temporarily halts collection efforts, foreclosures, and lawsuits.

This can provide relief from creditor harassment and give you the opportunity to resolve your financial situation through the bankruptcy process.

How much does it cost to file for bankruptcy?

The cost of filing for bankruptcy varies depending on the type of bankruptcy, attorney fees, and other expenses. It’s essential to consult with a bankruptcy attorney to discuss your specific situation and receive an accurate estimate of the costs involved.

Contact Us to Learn More About When to File Bankruptcy

If you’re struggling with debt and considering bankruptcy, don’t hesitate to reach out to our experienced team at LSS Law. We’re committed to helping people just like you remove the financial burden and open the door to a brighter future. Schedule a no-cost Bankruptcy Strategy Session for personal bankruptcy today by calling us at 954-466-0541 or visiting our contact page. We offer consultations via Zoom or in-person at our Fort Lauderdale and Miami locations for your convenience.