Dealing with debt can be stressful and make you feel isolated; however, remember that you are not alone. Many people in Florida have financial difficulties, and there is a way to help you take control of your money again. Bankruptcy lawyers in Florida are experts in helping people and businesses go through the difficult bankruptcy process. They can give you the advice and support you need to get rid of your debt and start over.

In this blog post, we will talk about the benefits of working with an experienced bankruptcy attorney and the different options available to people in Florida who have debt problems.

All About Bankruptcy Lawyers in Florida

Bankruptcy lawyers in Florida are legal experts who help people and businesses get rid of debt through careful bankruptcy planning. These attorneys know the federal bankruptcy laws and the special exemptions and requirements that are specific to Florida. They can guide you through the whole process, from figuring out if bankruptcy is the right choice for you to representing you in court and making sure that your rights are protected.

What Exactly is Bankruptcy?

Bankruptcy is a tool to help with your finances, not as terrible as it seems. It is meant to help people who have overwhelming debt by allowing them to get rid of it or reorganize it and start over. When filing for bankruptcy, individuals or businesses must submit their cases to a bankruptcy court, which oversees the proceedings to ensure that they are carried out according to the law.

A reputable bankruptcy law firm can provide valuable guidance and support during this challenging time. They can help you navigate the complexities of the various types of bankruptcy, including Chapter 7, Chapter 11, and Chapter 13. Each type has its own set of rules and benefits, and determining the most appropriate one for your specific situation is crucial for a successful outcome.

Bankruptcy cases can be complex, and it’s essential to have an experienced bankruptcy law firm by your side. A Florida bankruptcy lawyer can explain your options and guide you through the process from beginning to end. With this expertise, you can be assured that your case is handled efficiently and effectively, allowing you to focus on rebuilding your financial future.

What Types of Debt Can Bankruptcy Help With?

Bankruptcy can help you eliminate or manage various types of debt, including:

- Credit card debt

- Medical debt

- Personal loans

- Utility bills

- Mortgages

- Car loans

- Certain tax debts

- Some business debts

- Past due rent

However, it is essential to note that not all debts are dischargeable through bankruptcy, such as most student loans, child support, alimony, and recent tax debts. Working with an attorney who has been practicing bankruptcy law for a healthy amount of time will help you decide which debt relief avenue is best for you and your family.

Benefits of Working with a Bankruptcy Attorney

One of the primary advantages of working with Florida bankruptcy attorneys is their understanding of the state-specific exemptions and restrictions that can safeguard your assets during the bankruptcy process. For example, Florida has a generous homestead exemption that can protect an unlimited amount of equity in your main home, as well as exemptions for retirement accounts, certain types of income, and limited protections for personal property and vehicle equity.

By working with a well-known bankruptcy law office, you can make the most of these exemptions and protect as much of your property as possible.

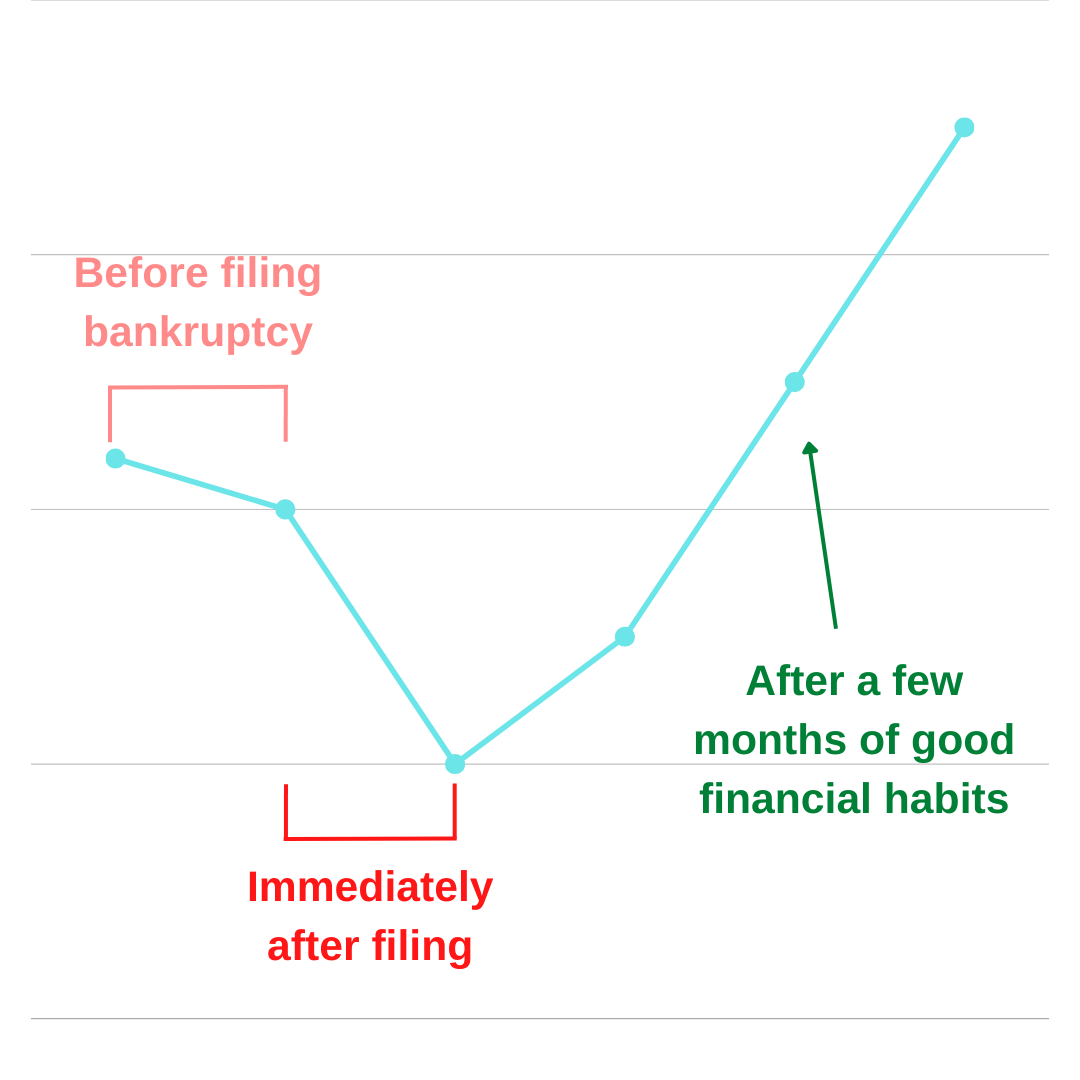

Another advantage of hiring a bankruptcy lawyer in Florida is their ability to help you improve your credit score over time. Initially, bankruptcy might have a negative influence on your credit, but with expert guidance and recommendations, you can begin rebuilding your credit and eventually have a higher score than before. This can open doors to new opportunities, like getting loans or credit cards with better terms and interest rates.

Additionally, Florida bankruptcy lawyers can give you valuable advice and resources for managing your finances moving forward. They can help you create a budget, find areas where you can spend less money, and give you advice on rebuilding your credit and savings. When you work with a bankruptcy attorney, you’re not only dealing with your current debt problems but also setting yourself up for a more stable and secure financial future.

Navigating Chapter 7 and Chapter 13 Bankruptcies in Florida

Two common bankruptcy options for individuals in Florida are Chapter 7 and Chapter 13. Chapter 7, also known as straight or liquidation bankruptcy, involves selling non-exempt assets to pay off creditors. To qualify for Chapter 7, Florida residents must pass the means test, which compares their income to the state’s median income and determines their disposable income. A Chapter 7 bankruptcy remains on a person’s credit report for ten years and can only be filed once every eight years if debts were discharged in the previous case.

On the other hand, Chapter 13 bankruptcy is designed for individuals with regular income who need a structured repayment plan. It allows debtors to keep their property while repaying debt over a period of 3-5 years. To qualify for Chapter 13, debtors need regular income, and their secured and unsecured debts must not exceed $2.75 million. The repayment plan is based on disposable income or the liquidation value of non-exempt assets. Chapter 13 can help stop foreclosure and catch up on missed mortgage payments, providing a more manageable solution for those struggling with debt.

Working with a bankruptcy lawyer in Florida can help you figure out which bankruptcy option is best for your situation and make sure that you meet all requirements and deadlines during the process.

Understanding Florida’s Bankruptcy Exemptions

When filing for bankruptcy in Florida, it’s essential to be aware of the state’s specific exemptions that protect certain assets from liquidation. Florida has a generous homestead exemption, which protects an unlimited amount of equity in a primary residence, subject to size limitations based on location. Additionally, the state’s motor vehicle exemption protects up to $1,000 in vehicle equity.

Retirement accounts are generally exempt from liquidation in Florida Chapter 7 Bankruptcy, and the state’s wildcard exemption allows for additional protection of personal property. Certain types of income and insurance benefits are also exempt from consideration in the means test and liquidation process. Working with a knowledgeable bankruptcy attorney in Florida can help you understand and maximize these exemptions to protect your assets during the bankruptcy process.

The Impact of Bankruptcy on Credit Scores in Florida

While filing for bankruptcy can have a negative impact on your credit score, it’s important to realize that with the appropriate advice, bankruptcy can also help improve credit scores over time. A Chapter 7 bankruptcy remains on an individual’s credit report for ten years, while a Chapter 13 bankruptcy remains on the report for seven years. However, by eliminating debt and responsibly managing finances after bankruptcy, individuals can gradually rebuild their credit and improve their financial standing.

An experienced bankruptcy lawyer in Florida can provide guidance on rebuilding credit after bankruptcy and help you develop a plan for responsible financial management moving forward.

The Importance of Working with a Bankruptcy Attorney in Florida

Navigating the complex bankruptcy process in Florida can be challenging without the guidance of an experienced bankruptcy attorney. A knowledgeable lawyer can help you determine the most appropriate bankruptcy option for your situation, ensure that you meet all requirements and deadlines, and maximize your exemptions to protect your assets.

Additionally, a bankruptcy attorney can provide valuable advice on rebuilding your credit and managing your finances after bankruptcy, setting you on the path to financial recovery. By working closely with a dedicated bankruptcy lawyer in Florida, you can overcome debt and work towards a brighter financial future.

Chapter 7 vs. Chapter 13: Choosing the Right Bankruptcy Option in Florida

Deciding between Chapter 7 and Chapter 13 bankruptcy can be a complex decision, as each option has its own benefits and drawbacks.

Before deciding which type of bankruptcy to file for, there are several things that need to be considered:

- Eligibility: Not everyone is eligible for Chapter 7 bankruptcy. To qualify for Chapter 7, you must pass the “means test,” which compares your income to the median income in your state. If your income is above the median, you may not be eligible for Chapter 7 and may need to consider Chapter 13.

- Goals: What are your goals in filing for bankruptcy? If you want to discharge as much debt as possible and start fresh, Chapter 7 may be a better option. However, if you want to keep certain assets, such as your home or car, Chapter 13 may be a better choice.

- Type of Debt: Some types of debt cannot be discharged in Chapter 7 bankruptcy, such as student loans and certain tax debts. If you have significant amounts of these types of debts, Chapter 13 may be a better option.

- Assets: If you have significant assets, such as a home or multiple vehicles, that you want to keep, then Chapter 13 which is similar to debt consolidation may be a better option. In Chapter 7, some assets may be sold to pay off your debts.

- Income: In Chapter 13, you will be required to make monthly payments to a bankruptcy trustee for three to five years. If you have a regular income and can afford to make these payments, Chapter 13 may be a better option. If your income is too low to make these payments, Chapter 7 may be a better choice.

Before making a decision, it’s crucial to consult with an experienced bankruptcy attorney in Florida who knows the bankruptcy laws before you file for bankruptcy to determine the most appropriate option for your specific situation.

Bankruptcy and Small Business Owners

Small business owners in Florida may face unique challenges when it comes to debt and bankruptcy options. For sole proprietors, personal and business debts are often intertwined, making it difficult to separate the two when considering bankruptcy. In such cases, filing for Chapter 7 or Chapter 13 bankruptcy may each be an option to address personal and business-related debts.

For partnerships, LLCs, and corporations, Chapter 11 bankruptcy may be a more appropriate option, as it allows businesses to restructure their debts and continue operating. However, this process can be complex and time-consuming, with significant fees involved. Small businesses with less than $7.5 million in debt may qualify for a streamlined Subchapter V process, which simplifies the Chapter 11 process and reduces costs.

Regardless of the business structure, working with an experienced bankruptcy attorney in Florida is essential for small business owners to navigate the complexities of bankruptcy and explore the best options for debt relief and continued operations.

Understanding Chapter 11 Bankruptcy for Florida Businesses

If your business in Florida is having financial problems, you might think about Chapter 11 bankruptcy as a way to reorganize your debts and keep your business running. This type of bankruptcy can help small and large businesses restructure their debts, save jobs, and maintain good relationships with creditors and suppliers. During the Chapter 11 process, the debtor stays in control of their business, unless a trustee is appointed.

When you file for Chapter 11 bankruptcy, an automatic stay is triggered. This gives you temporary relief from attempts to collect money, foreclosures, and lawsuits. You must submit a reorganization plan to the court, explaining how your business plans to pay back its creditors over time. Creditors are divided into groups based on the type of debt, and they can vote on whether to approve the reorganization plan. Throughout the process, the debtor needs to share all their financial information with the court and creditors.

Chapter 11 can help businesses get past financial problems and become stronger, but it can be a complicated, time-consuming, and expensive process. Talking to an experienced Florida bankruptcy attorney is important to figure out the best strategy to handle a Chapter 11 bankruptcy.

Fixing Your Credit After Bankruptcy in Florida

After you go through bankruptcy, it’s important to rebuild your credit so you can have a strong financial future. Even though a bankruptcy filing may stay on your credit report for up to ten years, you can take steps to improve your credit score over time.

One good way to rebuild credit is to get a secured credit card. This type of card requires a security deposit that sets your credit limit. By using the card responsibly and making payments on time, you can show that you are committed to managing your credit well. It’s also important to keep a low credit utilization rate, which is the percentage of available credit you’re using.

Another option is to get a credit-builder loan, which is designed specifically to help people with bad or no credit history build their credit. These loans usually have low borrowing limits and require you to make payments in installments over a set period.

You can also become an authorized user on a family member’s or friend’s credit card to benefit from their positive credit history. Just make sure the primary cardholder has a good payment history and a low credit utilization rate.

Keeping an eye on your credit reports and disputing any mistakes is an important part of rebuilding credit, too. Federal law lets you get one free credit report per year from each of the three major credit bureaus.

By taking these steps and working with a knowledgeable Florida bankruptcy attorney, you can take control of your financial future and rebuild your credit after bankruptcy.

Contact LSS Law for Florida Bankruptcy Solutions

Are you ready to take control of your financial situation? Contact the experienced bankruptcy attorneys at LSS Law today to schedule your free initial consultation for personal bankruptcy and start your journey toward debt relief. Call us at 954-466-0541. Send us an email at info@lss.law or visit our website at https://lss.law/contact-us to get started.

Common Questions About Florida Bankruptcy Lawyers

A bankruptcy filing can be confusing, and you probably have questions about how a Florida bankruptcy lawyer can help you. Here are some common questions and answers to help you understand more about your financial future.

How much does it cost to hire a bankruptcy lawyer in Florida?

The cost of hiring a bankruptcy lawyer depends on how complicated your case is and how much experience the attorney has. It’s important to talk about fees during your first meeting. At LSS Law, we offer a free consultation for personal bankruptcies (Chapters 7 or 13) to help you understand your options and how much it might cost.

Can a bankruptcy lawyer help me keep my home and car in Florida?

Bankruptcy lawyers can help you understand the specific exemptions in Florida that protect things like your home, retirement accounts, and limited protections for personal property and car equity. Depending on your situation, a bankruptcy attorney might be able to help you keep your home and car by carefully going through the bankruptcy process.

How long does the bankruptcy process take in Florida?

How long the bankruptcy process takes in Florida depends on what type of bankruptcy you file. Chapter 7 bankruptcy proceedings usually take four to six months to finish. For Chapter 13, the repayment plan lasts between three and five years.

A bankruptcy lawyer can provide legal representation and help you understand the timeline for your specific case, ensuring a smoother experience throughout the bankruptcy proceedings.

Can filing bankruptcy in Florida stop wage garnishments and collection actions?

Yes, filing bankruptcy in Florida triggers an automatic stay, which temporarily stops most debt collectors, including wage garnishments and bank levies. This can give you some relief while you work with your attorney to go through the bankruptcy process.

Can a bankruptcy lawyer help me with tax debts in Florida?

Bankruptcy lawyers can help you deal with tax debts through the bankruptcy process. While not all tax debts can be wiped out, certain older income tax debts might be eliminated if specific criteria are met. An experienced bankruptcy attorney can help you figure out if your tax debts can be dealt with through bankruptcy.

How can a bankruptcy lawyer help me rebuild my credit after bankruptcy?

A bankruptcy lawyer can give you guidance and suggestions for rebuilding your credit after bankruptcy. By following their advice and taking proactive steps, like getting a secured credit card or credit-builder loan, you can improve your credit score over time.

How does bankruptcy help with foreclosure defense?

In Florida, bankruptcy can help with foreclosure defense by providing immediate relief to those facing financial distress. Upon filing a bankruptcy petition, an automatic stay is imposed, which temporarily halts the foreclosure process. This allows homeowners time to explore their options and negotiate with lenders. Bankruptcy law firms can guide homeowners through this process, ensuring that they make the best decisions for their specific situation.